PART VII - COLLECTION AND RECOVERY OF TAX Chapter. 2 The taxable income of a taxpayer for a taxation year is the taxpayers income for the year plus the additions and minus the deductions permitted.

Unemployed Protect Your Future Earnings Law Office Bankruptcy Law

1 Every person deducting tax in accordance with the foregoing provisions of this Chapter shall within such period as may be prescribed from the time of credit or payment of the sum or as the case may be from the time of issue of a cheque or warrant for payment of any.

. A bond issued to refund an obligation described in section 103o3 of the Internal Revenue Code of 1954 as in effect on the day before the date of the enactment of the Tax Reform Act of 1986 Oct. For purposes of applying section 103o of the Internal Revenue Code of 1986 formerly IRC. Section 103 of the CGST Act.

Income Tax Act must be considered. 2 For the. 1 Except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not that.

28 of 2011 the TAAprescribing the rules related to. Recovery from persons leaving Malaysia 105. In this regard.

Section 1032 is an anti-avoidance provision which essentially allows the Commissioner of the South African Revenue Service the Commissioner to disallow the setting off of an assessed loss or balance of an assessed loss against the companys income if certain requirements are met. In terms of section 1034 of the Income Tax Act the taxpayer bears the onus of proving or showing that the relevant change in shareholding was not entered into with the sole or main purpose of. Recovery by suit 107.

PART VII - COLLECTION AND RECOVERY OF TAX Section. Section 1032 is an anti-avoidance provision which essentially allows the Commissioner of the South African Revenue Service the Commissioner to disallow the setting off of an assessed loss or balance of an assessed loss against the companys income if. Applicability of advance ruling.

In terms of Government Notice No. In this regard the provisions of section 1032 of the Income Tax Act must be considered. PART VII - COLLECTION AND RECOVERY OF TAX Section.

Certificate for tax deducted. 22 1986 shall not be treated as described in section 144b of the 1986 Code unless it. Income tax act means the income tax act 1962 act no.

There are changes that may be brought into force at a future date. Payment of tax 103 A. Income Tax Act Part.

Income Tax Act 2058 2002. PLR200646017 Tax Exempt Interest under Section. Income Tax Act 2007 Section 103 is up to date with all changes known to be in force on or before 05 April 2022.

Refusal of customs clearance in certain cases 106. 1 Where a resident taxpayer derives foreign source income chargeable to tax under this Ordinance in respect of which the taxpayer has paid foreign income tax the taxpayer shall be allowed a tax credit of an amount equal to the lesser of. Section 103A formerly read.

Section 103 of the Income Tax Act No. Tax Avoidance and Section 103 of the Income Tax Act 1962. Permits licences and rights.

FEBRUARY 2017 ISSUE 209. Services for foreign nationals. This responds to a request for a ruling either that 1 Authority qualifies as a political subdivision for purposes of 103 of the Internal Revenue Code the Code or 2 the debt of Authority is issued on behalf of City within the meaning of 1103-1 b of the Income Tax Regulations.

Section 203 of the Income Tax Act. 1 The advance ruling pronounced by the Authority or the Appellate Authority under this Chapter shall be binding only. B on the concerned officer.

1 Where a resident taxpayer derives foreign source income chargeable to tax under this Ordinance in respect of which the taxpayer has paid foreign income tax the taxpayer shall be allowed a tax credit of an amount equal to the lesser of. Rules promulgated under section 103 of the tax administration act 2011 act no. A on the applicant who had sought it in respect of any matter referred to in sub-section 2 of section 97 for advance ruling.

Section 103 2 is an anti-avoidance provision which essentially allows the Commissioner of the South African Revenue Service the Commissioner to disallow the setting off of an assessed loss or balance of an assessed loss against the companys income. B the Pakistan tax payable in respect of the income. PART VII - COLLECTION AND RECOVERY OF TAX Chapter.

Tax Avoidance and Section 103 of the Income Tax Act 1962 Revised Proposals You are invited to send your comments regarding these revised proposals on or before 13 October 2006 to. Section 103 2 of the Income Tax Act 1962 the Act empowers the Commissioner for the South African Revenue Service SARS to disallow the setting off of an assessed loss or balance of an assessed loss against the companys income if the relevant requirements are met. Revised legislation carried on this site may not be.

Deduction of tax from emoluments and pensions 107 A. 2 1 An income tax shall be paid as required by this Act on the taxable income for each taxation year of every person resident in Canada at any time in the year. Changes that have been made appear in the content and are referenced with annotations.

In this regard the provisions of section 103 2 of the Income Tax Act must be considered. Income Tax Act 1967. Section 1013c15 of Pub.

Ad Find Deals on turbo tax online in Software on Amazon. 1954 the term consumer loan bond shall not include any mortgage subsidy bond within the meaning of section 103Ab of such Code to which the amendments made by section 1102 of the Mortgage Subsidy Bond Tax Act of 1980 enacting section 103A. Deduction of tax from.

27 12 422 4035 Due to time constraints it will not be possible to respond individually to comments received. 58 of 1962 the Act lays down a set of interlocking criteria which determine whether a particular tax avoidance scheme falls foul of the section. Lodging an objection or appeal against an assessment or decision.

Income Tax Act Part. Provisions supplementary to sections 101 and 102. 1 Where sales of associated parcels of shares in a company being sales to the same person take place at different times and in consequence of any of the sales other than the first that person obtains control of the company then for the purposes of either of.

Deleted by Act A1151 History Section 103A deleted by Act A1151 of 2002 s16 with effect from year of assessment 2004. Security for tax payable by withholding. 28 of 2011 prescribing the procedures to be followed in lodging an objection and appeal against an assessment or a decision subject to objection and appeal referred.

550 published in the Gazette on 11 July 2014 new rules werepromulgated under section 103 of the Tax Administration Act No. B the Pakistan tax payable in respect of the income. Western Cape Tax Court decision Case No IT.

Payment of tax by companies deleted by Act A1151. Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal. If the answer is affirmative the Commissioner is empowered to ignore the scheme for tax purposes or to take such action as is necessary to nullify the tax.

If Deduction Towards Expenses Is Not Denied Then The Liability Related To Such Expenses Can Not Be Treated As Unexplained Liability Deduction Income Tax Taxact

Do You Need Personal Business Loan At 3 If Yes Contact Us For More Info Email Farhanaziz Financehome Aol Com Business Loans Business Person 24 Hour Service

Unemployed Protect Your Future Earnings Law Office Bankruptcy Law

Filing Makes Expanding Your Business Easier In 2022 Income Tax Return Tax Return Income Tax

Pin By The Taxtalk On Income Tax Deposit Accounting Cash

Tax Rules For Investment In Real Estate By Non Resident Indians Investing Tax Refund Personal Loans

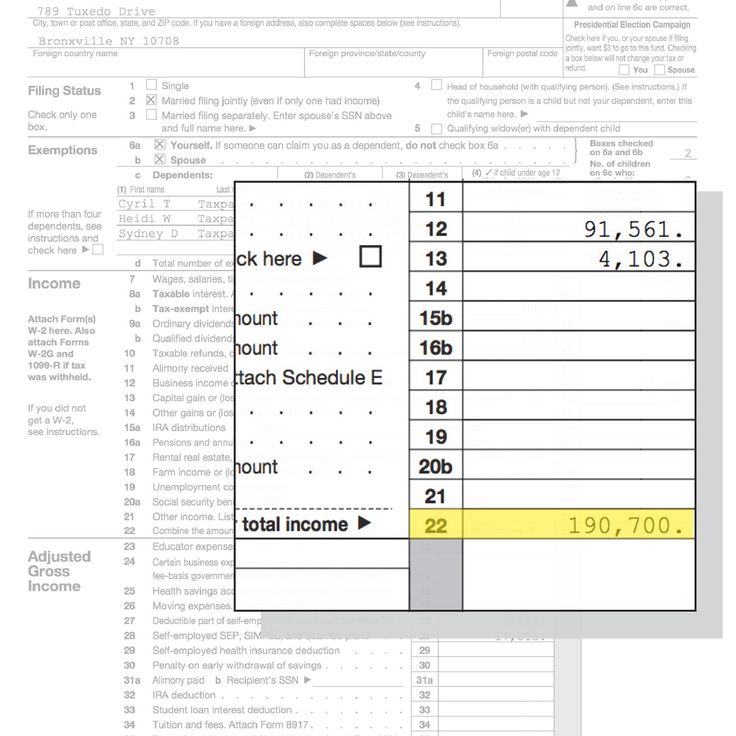

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

U S Master Tax Guide Hardbound Edition 2020 Wolters Kluwer Tax Guide Pdf Books Free Pdf Books

Latest News Chartered Accountant Insurance Industry Dividend

Taxes Around The World Infographic

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

Make Money With Craigslist Money Stories How To Get Money Money Online

Taxupdate Taxlaw Tax Taxsaving Taxseason Taxrefund Taxreturn Incometaxseason Incometax Incometaxreturn Chart Income Tax Return Income Tax Tax Refund

Pin On Banking Financial Awareness

More Good Tax Form Design Irs Forms Tax Forms Form Design

Hybrid Approach It Staff Augmentation Outsourcing Outsourcing Business Strategy Augmentation